30+ Long term disability insurance

Most group long-term disability plans have an elimination period of 90 days or 180 days. What Happens to Long Term Disability When Terminated.

2

The benefit period determines how long claim payments last.

. Voluntary Group Short and Long Term Disability Plan Highlights. The standard length is 60 or 90 days. Elimination periods can be as short as 30 60 or 90 days or as long as 6 months or a year.

Individual long term disability insurance requires full underwriting. How does long-term disability insurance work. Available in flat dollar amount percentage of salary or increments.

Insured can choose a longer elimination period to lower premiums. If you are working -- or are unemployed and have been collecting unemployment benefits for less than four weeks -- at the time your disability began you will file a DB-450 form. Benefits can run one two.

It is very important to note that if you become disabled and qualify for short-term disability insurance you must file your claim within 30 days of becoming disabled. Long Term Disability LTD If an employee is continuously disabled six 6 months after the disability began he. Under most group plans generally the employer selects the elimination period.

90 days on most standard policies. If you need to file a complaint against an insurance. Plan Costs FY 2022-23 Optional Long-Term Disability LTD Percent of Earnings.

The employee contribution rate is 05 of the first 12000 of weekly wage up to a maximum of 60 per week or 3120 per year. Learn about Life Insurance Disability Insurance Long-Term Care Insurance. The hypothetical policy has a 30-day waiting period a 12-month benefit period and a 3000 monthly benefit about 70 percent of the income for a person.

What States Require Short Term Disability Insurance. Benefits up to 60 of salary. Thats where Aflacs short-term disability insurance policy can help make the difference.

If you become too sick or hurt to work your long term disability insurance policy will pay you directly monthly benefits that replace part of your income. Long-term care insurance generally covers the costs of care needed beyond 100. According to the American Association for Long-Term Care Insurance AALTCI a couple in their mid-50s can purchase a new long-term care policy for around 3000 a year.

It provides a monthly income benefit for employees who are unable to work for a lengthy period of time because of a totally disabling illness or injury. 15 20 or 30 years. Elimination periods for long term disability can be as little as 30 days or as long as a year.

The elimination period for Workers Compensation is seven 7 days of disability however the period does not need to be consecutive. Employees regularly scheduled to work 12 hoursweek are eligible to enroll. Gross wage before taxes and insurance.

Maximum short term benefits up to 1250 per week. However for many policies there may be monthly maximums which put a limit on the amount you can receive. Mental Disorders 30 Musculoskeletal 21 Cancer 13 Circulatory 7 Nervous System 7 Accidents 9 All other 13.

How Much Does Short Term Disability Cost. Most importantly you must have non-occupational off-the-job coverage in force before you can apply for benefits by filing a claim. The benefit period is the period during which disability benefits are paid out.

Short-term disability insurance pays out a specific percentage of your pre-disability income such as 40 or 60 of your pay. Periods on Breeze policies range from 30 to 180 days. 30 day waiting period.

Premium waived month to month for policy and any applicable riders for as long as you remain disabled up to the applicable benefit period shown in the Policy. Under most group plans generally the employer selects the elimination. Basic Long Term Disability.

Short-term disability insurance benefits have an expiration date which is typically no longer than six. This benefit is only available to active employees. Once a plan is in place the employee must provide medical proof of a.

The combined benefit of this plan would be roughly 770000. It depends on your disability insurance policy. For employer-sponsored group long term disability insurance benefits can cover 50 to 80 of your pre-disability salary with a typical policy covering 6666.

A persons eligibility for short-term disability insurance in Colorado depends on many variables. If you have significant savings you may be willing to choose a longer elimination period. In California for instance employees get at least 30 days of paid sick leave within a year.

Single premium Pay to age 95 Long-term care insurance policy no death benefit LTC maximum monthly benefit. Long-term disability insurance is designed to help replace your income for a greater period of time if your injury illness or condition. Standard Insurance Company administers disability coverage.

Maximum long term benefits up to. Find out how you can protect your assets for you and your family. LTC total available benefit amount.

Long-term disability works in much the same way as short-term disability. Thirty 30 consecutive calendar days of disability. Most long-term disability insurance policies are the most cost.

Complaints Against Long-term Disability Insurance Companies in Canada. How much will I receive from long term disability insurance benefits. You are automatically enrolled in Basic Long Term Disability at no cost if you enroll in health insurance.

The Long-Term Disability component of the Public Service Management Insurance Plan PSMIP is available to employees of the federal public service who are excluded from the collective bargaining process. Insurers have to assess a persons risk of filing a claim because benefits may be paid out for a long period. The Long Term Disability carrier has asked you to complete an Activities of Daily Living form in which you are asked to document what you are physically capable of doing.

The maximum benefit is 800 per. The employer contributes the remainder of plan costs if any costs remain. In that form or even in a statement you might tell the Long Term Disability insurance company that you always use a cane or that you always limp.

The shortest elimination period available is 30 days. 14 days is most common. 3 6 12 or 24 months.

You can choose a plan that pays out benefits for two years five years 10 years or until retirement. We compare the best long-term disability insurance options based on coverage wait periods price and more. Short-term disability insurance SDI can provide income when recovering from surgery or a temporary disability.

How Much Does Disability Insurance Cost. Most group long term disability plans have an elimination period of 90 days or 180 days. Long term disability insurance through your employer can provide a steady stream of income to help cover essential expenses during an extended illness or after a disabling accident.

When you choose disability coverage consider how long you can manage without a paycheck. If your disability benefits are paid by an insurance company then your. View our short video that answers questions you may have about Voluntary Disability insurance.

They can also earn one hour of paid leave for every 30 hours worked. Permanent Life Provides a death benefit and has a cash value component that you may be. Long term disability coverage is available to eligible employees.

Each province has a government agency that regulates insurance companies. Optional Long-Term Disability LTD pays you 60 of your earnings if you cannot work for an extended period due to a disabling illness or injury. INJURYSICKNESS 07 014 77 714 1414 030 3030 6060 9090 180180.

A Note About Pay Stubs Payroll Template Payroll Checks Templates

2

Sex Differences In Sepsis Hospitalisations And Outcomes In Older Women And Men A Prospective Cohort Study Journal Of Infection

Get Our Image Of Lawn Care Business Budget Template For Free Budget Planner Template Household Budget Template Business Budget Template

30 Food Infographics You Can Edit And Download

Raw Probiotics Vaginal Care Shelf Stable Garden Of Life

Disability Insurance For Physicians A Definitive Guide

Raw Probiotics Vaginal Care Shelf Stable Garden Of Life

Pin Em Popular Science

Yeast Infection Discharge

3

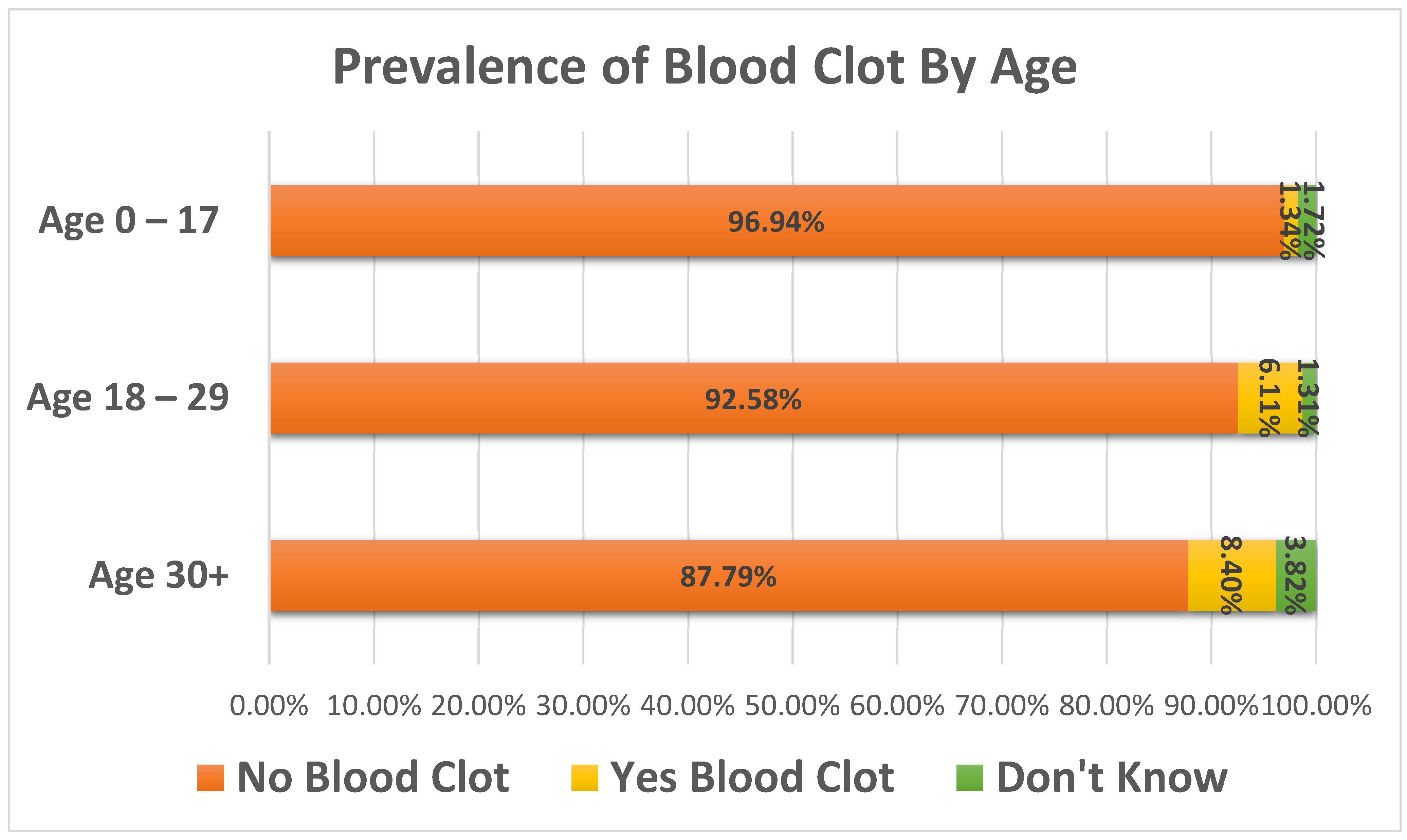

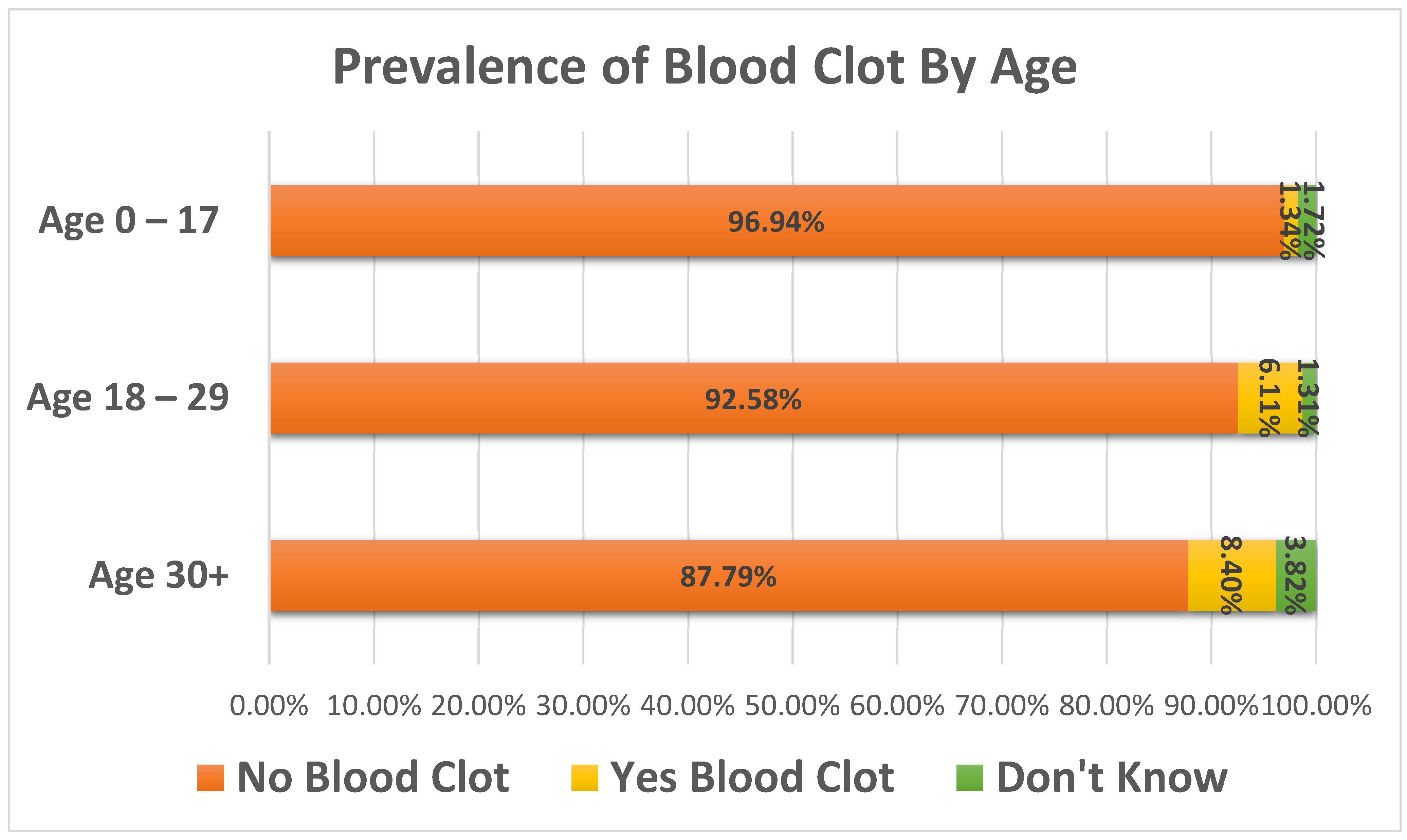

Jcm Free Full Text Thrombosis Risk History And D Dimer Levels In Asymptomatic Individuals With Prader Ndash Willi Syndrome Html

Key Person Disability Insurance Guide What You Need To Know

3 Financial Tools You Need In Your 30 S Stewardship Mortgages Insurance Financial Planning Estate Planning

The Learning Video Playbook 30 Tips For Making Instructional Videos

1

Bv Discharge Look Like